THE #1 SELLING STUDY APP NOW HAS THE MOST CURRENT EXAM QUESTIONS. PASS YOUR EXAM AT THE FIRST ATTEMPT BY STUDYING ANYWHERE, ANYTIME WITHOUT THE INTERNET CONNECTION.

Before you buy another app, ask yourself:

- Does it Offer REAL EXAM questions and terminology? WE DO!

- Does it Break learning materials into small sets of questions to enhance your learning capability? WE DO!

- Does it Help you master each question effortlessly by various methods: flash cards, matching game, true/false, M/C, etc? WE DO!

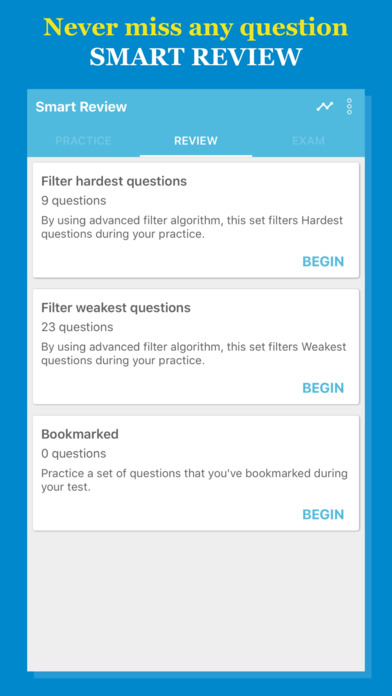

- Does it Detect & separate the most difficult questions automatically? WE DO!

- Does it Track your learning process on every set and exam taken? WE DO!

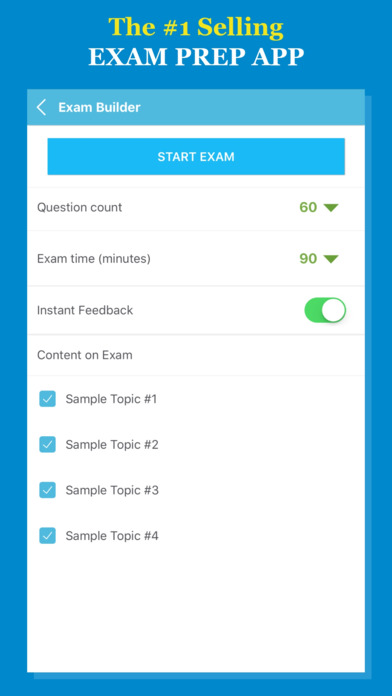

- Does it Let you experience the REAL EXAM Simulator? WE DO!

Premium Upgrade:

+) Lifetime access to all Practice Tests.

+) Lifetime access to the EXAM SIMULATOR.

+) Track all hardest and weakest questions automatically.

+) Track history on every exam taken and practice progress.

+) Lifetime support & updates when NEW learning material available.

Free with download:

+) Hundreds of practice questions & terms

+) Free Exam Builder

+) Free Matching Game

+) Filter hardest and weakest questions

The Uniform Certified Public Accountant Examination is the examination administered to people who wish to become U.S. Certified Public Accountants. The CPA Exam is used by the regulatory bodies of all fifty states plus the District of Columbia, Guam, Puerto Rico, the U.S. Virgin Islands and the Northern Mariana Islands.

In order to become a CPA in the United States, the candidate must sit for and pass the Uniform Certified Public Accountant Examination (Uniform CPA Exam), which is set by the American Institute of Certified Public Accountants (AICPA) and administered by the National Association of State Boards of Accountancy (NASBA). The CPA designation was first established in law in New York State on April 17, 1896.

The exam has been reduced in time to a fourteen-hour exam, and the sections have been reorganized as follows:

Auditing and Attestation (4.0 hours): (AUD) – This section covers knowledge of planning the engagement, internal controls, obtaining and documenting information, reviewing engagements and evaluating information and preparing communications.

Financial Accounting and Reporting (4.0 hours): (FAR) – This section covers knowledge of concepts and standards for financial statements, typical items in financial statements, specific types of transactions and events, accounting and reporting for governmental agencies, and accounting and reporting for non-governmental and not-for-profit organizations.

Regulation (3.0 hours): (REG) – This section covers knowledge of ethics and professional responsibility, business law, Federal tax procedures and accounting issues, Federal taxation of property transactions, Federal taxation – individuals, and Federal taxation – entities.

Business Environment and Concepts (3.0 hours): (BEC) – This section covers knowledge of business structures, economic concepts, financial management, information technology, and planning and measurement.

Regulation topic cover

15-19% ethical and legal responsibilities

17-21% business law

11-15% federal tax process

12-16% gain and loss taxation

13-19% individual tax

18-24% taxation of entities

Disclaimer:

This application is just an excellent tool for self-study and exam preparation. Its not affiliated with or endorsed by any testing organization, certificate, test name or trademark.